California Paycheck Calculator After Taxes: Get Your Net Pay Now!

Are you tired of guessing how much of your hard-earned money actually makes it into your pocket after taxes? Understanding your net pay the amount you actually take home is crucial for managing your finances effectively and planning for your future. This is where the power of a paycheck calculator comes in, especially when navigating the complexities of state and federal tax systems.

The realm of payroll calculations can often feel daunting. It's a complex interplay of gross pay, various tax withholdings (federal, state, and sometimes even local), and deductions for benefits like health insurance and retirement plans. This article delves into the intricacies of paycheck calculators, with a particular focus on how they function in the context of California's unique tax landscape. We'll explore how these tools can empower you to understand your earnings, plan your budget, and make informed financial decisions.

Before we dive into the specifics, let's clarify the basics. A paycheck calculator's primary function is to estimate your "net pay," often referred to as "take-home pay." This represents the money you receive after all deductions and taxes have been subtracted from your gross earnings. It offers a clear picture of your financial standing, which is critical for managing expenses, saving, and investing. These calculators are essential for both employees and employers, enabling them to navigate the often complex rules of payroll processing and tax regulations.

- Benny Blanco Net Worth Selena Gomez Music Career Explained

- Del Mar Racetrack Race Results Everything You Need To Know

Let's address a common misconception: the notion that all states levy income taxes equally. The reality is far more nuanced. While some states, like Alaska, Texas, Florida, Nevada, and Washington, offer the benefit of no state income tax, others, such as California and New York, have comparatively high state income tax rates. These differences significantly impact your net pay. A paycheck calculator is an excellent tool to understand these state-by-state differences.

Let's consider the practical application of a paycheck calculator. The process usually starts with inputting your gross pay your earnings before any deductions. You'll then need to provide information about your filing status (single, married filing jointly, etc.), the number of dependents you claim, and any pre-tax deductions, such as contributions to a 401(k) or health insurance premiums. The calculator then uses this information, along with the current tax rates (federal, state, and potentially local), to estimate your total tax liability and deductions. Ultimately, it provides you with an accurate estimate of your net pay.

The California hourly paycheck calculator and the California annual salary after-tax calculator are specifically designed to provide insights into earnings after deductions for individuals working in the Golden State. The annual salary calculator is a particularly useful tool for working out your income tax and salary after tax based on an annual income. These calculators are updated with the latest income tax rates in California, which are essential for accurate calculation.

- Contact Dermatitis Causes Symptoms Treatments Discover

- Funeral Services In Chapmanville Wv Freeman Funeral Home More

Payroll tax modeling calculators go a step further. They often include federal, state, and local taxes, as well as benefits and other deductions, to provide a comprehensive overview of your pay breakdown. This type of calculator can show you how different financial choices impact your take-home pay. The calculator's ability to provide this type of detail allows employees to make informed decisions based on their specific circumstances.

Beyond the basic calculation, paycheck calculators provide many practical benefits. They help you understand your tax liabilities, allowing you to plan for significant financial decisions, such as buying a home or planning for retirement. They can also be a valuable tool for comparing salary offers from different employers, as they provide a clear picture of your net income after taxes and deductions.

One often overlooked but critical aspect of using a paycheck calculator is the ability to test different scenarios. You can experiment with various scenarios to see how changes in your income, tax withholdings, or contributions to retirement plans impact your net pay. It empowers you to model different situations, allowing you to make informed decisions regarding your finances.

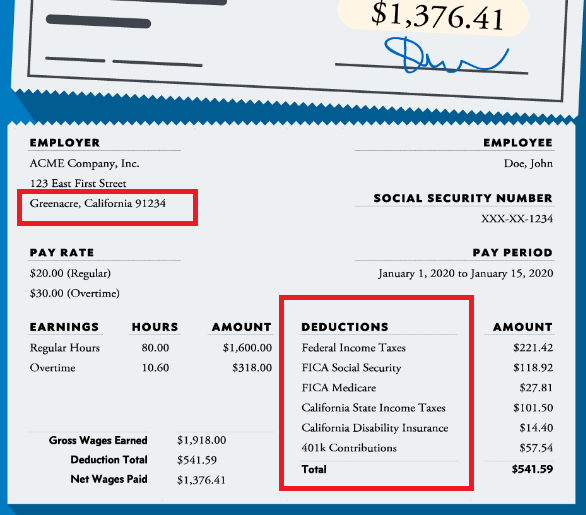

Now, let's explore the components of a paycheck. Unless they are exempt, your employees will pay federal income tax. You must withhold federal income tax from employees pay unless they are exempt. The primary components are:

- Gross Pay: This is the total amount of money you earn before any deductions. This includes your salary or hourly wage, plus any overtime pay, bonuses, or commissions.

- Federal Income Tax: This is a percentage of your earnings that goes to the federal government. The amount you pay is based on your income level, filing status, and the number of dependents you claim.

- State Income Tax: This is similar to federal income tax but is collected by your state government. The rates and rules vary significantly from state to state.

- FICA Taxes: These are taxes for Social Security and Medicare, which are mandatory contributions that support these government programs.

- Other Deductions: This includes things like contributions to a 401(k) or other retirement plans, health insurance premiums, union dues, and any other voluntary or mandatory deductions.

The key to correctly using a paycheck calculator is to provide accurate information. This includes your gross pay, filing status, the number of dependents you claim, and any pre-tax deductions. The more precise the information, the more accurate the estimated net pay will be. Note that the calculator uses gross pay, federal and state taxes, fica taxes, and other deductions to estimate how much money is taken out from your paycheck.

For the California hourly paycheck calculator and the annual salary after-tax calculator, accuracy is paramount. These tools are particularly helpful for providing accurate insights into the earnings of individuals in the Golden State, as they are updated with the latest income tax rates in California. These calculators are designed to be used online with mobile, desktop and tablet devices, making them accessible to many users.

The payroll tax calculation tools that are available have a wide range of uses, from simple estimates to providing insight into tax planning. One of their main benefits is that you can quickly compare different job offers or assess the impact of a raise or bonus on your take-home pay. Budgeting and financial planning become much easier when you can estimate your net income accurately. These calculators are also vital tools for employees who work multiple jobs or have a spouse who also works.

How to use a Paycheck Calculator Effectively

Using a paycheck calculator effectively involves a few key steps:

- Input Your Information: Start by entering your gross pay. Then, provide all the requested information, including your filing status, the number of dependents, and any pre-tax deductions.

- Understand the Results: Pay close attention to the breakdown of your paycheck. Understand how much is being deducted for each tax and deduction category.

- Experiment with Scenarios: Use the calculator to model different scenarios. Change your filing status or the amount you contribute to a retirement plan and see how it impacts your net pay.

- Use it Regularly: Review your paycheck regularly, comparing it to the calculator's results to ensure accuracy.

When completing this form, employees typically need to provide their filing status and note if they are claiming any dependents, work multiple jobs or have a spouse who also. A comprehensive understanding of this information is key to using a paycheck calculator correctly. By understanding and using the tools available, you can make informed financial decisions.

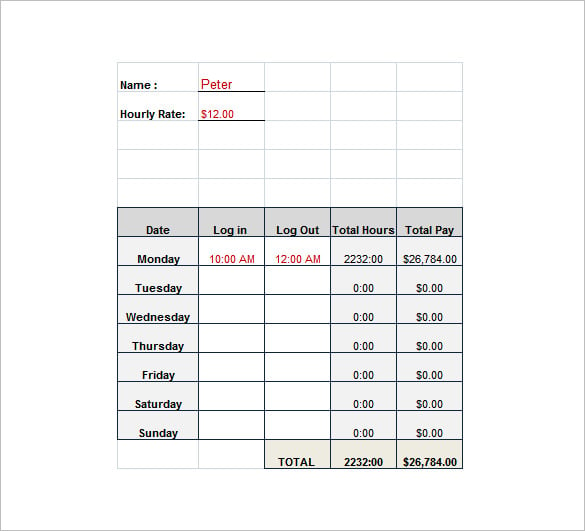

Example: Simplified California Paycheck Calculation

Let's illustrate a simplified example. Imagine an individual in California with an annual salary of $60,000, filing as single, with no dependents, and contributing $500 per month to a 401(k). Using a California paycheck calculator, you would input this information. The calculator would then calculate the federal and state income tax withholdings, FICA taxes (Social Security and Medicare), and the 401(k) contribution. The calculator would provide an estimated net pay (take-home pay) for each pay period.

The beauty of these tools lies in their ability to adapt to various scenarios. You can use them to estimate your pay across different pay periods (weekly, bi-weekly, monthly) or calculate your tax liability on an annual basis.

Important Considerations

While paycheck calculators are incredibly useful, keep these points in mind:

- Estimates, Not Exact Amounts: Paycheck calculators provide estimates. The actual amount withheld from your paycheck may vary slightly due to rounding or other factors.

- Tax Laws Change: Tax laws are subject to change. Make sure the calculator you are using is updated with the latest tax rates and regulations. The annual salary calculator is a great tool for working out your income tax and salary after tax based on a annual income and is updated with the latest income tax rates in California for 2025.

- Seek Professional Advice: If you have complex financial situations, such as investments or significant self-employment income, consider consulting a tax professional for personalized advice.

Here's a breakdown for your convenience of some key points:

- Paycheck calculators determine net pay (take-home pay), accounting for wages after withholdings and taxes.

- Many states have no income tax, such as Alaska, Texas, Florida, Nevada, and Washington, unlike states like California and New York.

- The calculator uses gross pay, federal and state taxes, fica taxes, and other deductions to estimate how much money is taken out from your paycheck.

- You must withhold federal income tax from employees pay, unless they are exempt.

- The California hourly paycheck calculator is a specialized tool.

- The annual salary calculator is updated with the latest income tax rates in california for 2025.

In conclusion, paycheck calculators are a vital resource for anyone wanting to understand and manage their finances effectively. They empower you to take control of your financial future by providing clear insights into your earnings and helping you plan for your financial goals. Whether you are a salaried employee, an hourly worker, or someone looking to compare salary offers, using these calculators regularly can prove to be an invaluable financial tool. You can use these tools in various situations, from assessing your current pay to planning your financial future.

- Revealed Kim Reeves Life Connection To Keanu What You Didnt Know

- Carrie Underwood Friends Nye Bash On Abc

The Ultimate California Paycheck Calculator Guide

California Paycheck Calculator 2025 Marius F. Rasmussen

California Paycheck Tax Calculator 2024 Dorie Larina